Value Everything Else

It may sound a little strange at first, but as George Carlin famously pointed out, our stuff matters. Material things aren’t more important than people or values or love or puppies, but our stuff is what we surround ourselves with and one of the things that makes a home a home. What we choose to own, display, wear, or use, are essential parts of how we define ourselves. Sharing our stuff with others or deciding who gets our stuff when we die sends a strong message about bigger things – the ones we can’t inventory and which can’t be assigned a dollar value.

In short, it’s fine to value my stuff as long as I understand the role it plays and what it can and can’t do. As a wise man once said, the best way to make sure material goods aren’t controlling you is to control them first.

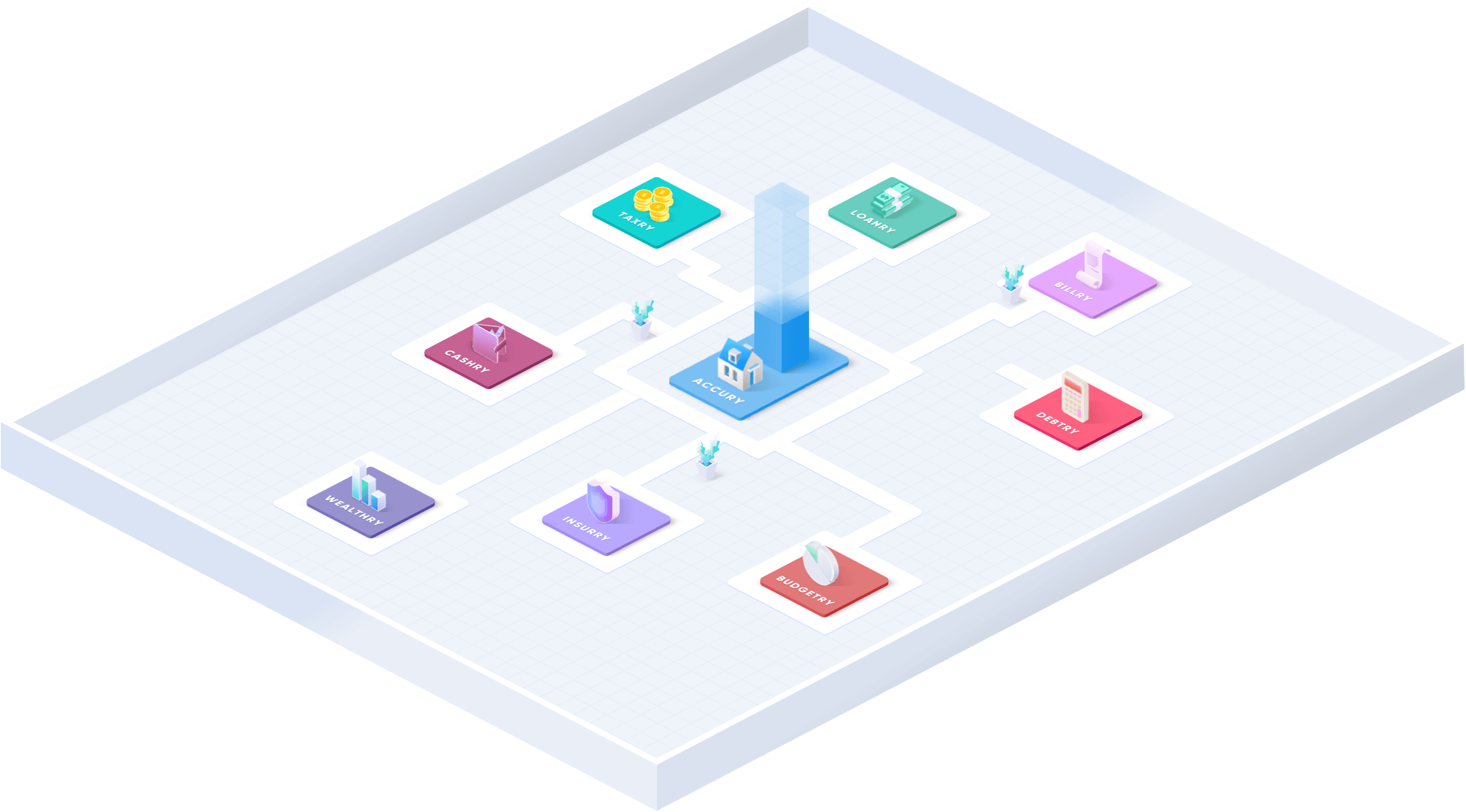

At Accury, we’re revolutionizing practical access to accurate information and professional insight about residential and commercial real estate. Our re-imagined use of personal technology to make accūRATE property appraisal information as easy to access as today’s weather forecast or last night’s sports scores brings fresh life to the old adage that “knowledge is power.”

The imminent release of the EquityMizer will allow anyone considering remodeling or renovating to accurately assess the impact of specific changes to their owner’s equity or their home’s precise market value. We have a core convictions here at Accury and across the Goalry family that most people are perfectly capable of taking more effective control of their personal and small business finances if only provided with the right information, insight, opportunities, and tools to make it happen.

You don’t need us or anyone else to tell you what to do. What most of us need is easier access to information already out there, from wherever you happen to be, and whenever you actually need it. There’s no reason for this to remain theoretical or languish in the “maybe someday” pile. It’s time we talk about how I can more efficiently and effectively value my things or accurately assess the worth of any item I’m considering acquiring.

At Accury, we’ve made our name revolutionizing personal access to certified real estate appraisals and making more informed home improvement decisions by calculating equity impact ahead of time. The best technology doesn’t try to tell you what to do – it gives you more complete information in more useful forms, when and where you need it, from any connected device, as efficiently as possible. The best technology is about access and organization of knowledge, and knowledge – as you know – is power.

In the mind of the average American, there are few estimates we trust as readily as we do a detailed truck or car valuation. It’s considered reckless these days to make an offer on any used vehicle without first researching the truck or car book value. And what “book” is that? For most buyers, it’s the Kelley Blue Book. Over the course of nearly a century, they’ve become a more accepted authority on truck or car value than the manufacturers or dealers themselves. How?

It’s not that their methodology is particularly complex. The way they determine truck resale prices or find car value comparisons has two basic elements, neither of which are industry secrets.

First, they draw on experts in the field. They know makes and models and engines and features and materials and mileages and safety records and all the rest because they’ve either established a reliable network of professionals in those arenas or assembled their own teams drawn from those professions.

Second, they’ve made effective use of modern data-crunching technology to process thousands and thousands of sales by dealers, individuals, auction-houses, in person, online, or in whatever other format they may occur. They not only know how to find truck or car value as an average of similar vehicles being bought and sold across the country, but how to determine truck prices in urban vs. rural areas or find car value ranges for Wisconsin vs. Kansas vs. North Carolina.

We treat truck or car book value as unquestionable because someone figured out how to make more efficient use of information that was already out there but too unwieldy for the average person to utilize effectively. They unlocked the potential of technology to take in vast quantities of data and filter it through experts in car appraisal in order to better organize and interpret it. Then they made it easy to access and use, from wherever you happen to be, whenever you happen to need it.

But why should car valuation be the only field in which you have so much access with only a few swipes or clicks?

As recently as a generation ago, any monetary value my things might have was largely determined by whatever was in walking or driving distance of my home or workplace. That meant my Uncanny X-Men #266 in mint condition might be worth three or four mortgage installments if I lived in the right section of a big enough city. Or, it might barely cover this week’s groceries if sold in my own little suburb. Your options and access to information were limited by the whims and priorities of a handful of “experts” or local shops.

A generation ago, the value of furniture appraisal, for example, was largely local. It made perfect sense to do an online search (or better yet, use the “yellow pages” if you’re old enough to remember those days) for “furniture appraisers near me.” If they weren’t near me, what was the point? The furniture I needed appraised was “near me” and it would have cost a fortune to send it anywhere else. Using furniture appraisers near me to value my things made perfect sense. As you may have noticed, the world has grown considerably smaller and more intimately connected in a brief amount of time. That may come with its own downsides, but if I’m looking to value my stuff accurately, it’s a net plus.

Let’s consider another example. Maybe you inherited a grandfather clock, unusual pocket watch, or other interesting timepiece from a family member. You head to the local expert to get a watch appraisal and they charge you to produce a piece of paper with a dollar value scribbled on it. The result means it will cost more than you’d hoped to insure it, so you offer to sell it to the shop which just documented how valuable it is. They offer you 10% or 20% of the figure they gave you, explaining that they don’t really have a market for these particular timepieces and besides, they have to make a little profit themselves to keep the doors open.

How different would that watch appraisal be if you had access to three specialty shops in the same city? Or seven? Or dozens? How much more could you expect to make selling that timepiece if you had access to dozens of professional clockmakers, watch repairmen, antique collectors, and other experts in the field at the same time and with less effort than it took to hunt down the one in the same ZIP code as yourself?

The value my stuff has to me personally may not change much from place to place, from brick-and-mortar locations to online marketplaces, or from evaluation to evaluation. The value my stuff has in terms of dollars and cents, however, can be dramatically different from the “take it” or “leave it” offered at Bill’s Clock’n’Hock once I have 24/7 access to dealers, collectors, appraisers, and other interested experts from all over the country with only a few swipes or clicks.

At some point in modern American life, most of us are going to need credit. Perhaps we want to finance a vehicle or purchase a home. Maybe we’d like to pay for our daughter’s education or help with our son’s wedding. It could just be that we all deserve a vacation. Unless our credit is perfect, it may be difficult to get the terms we’d like. Even reputable online lenders have to minimize risk and make a reasonable profit. Your ability to provide documented collateral can be a game-changer for approval or interest and other costs associated with taking out a personal loan.

If you’ve inherited a chest of diamonds or an oil well, no problem. I’ve never had trouble trying to value my things when they’re the same things everyone else wants and values. But what if it’s something a bit harder to appraise accurately? What if you need a reliable value most lenders would accept for collateral? Maybe you have a rare manuscript or musical instrument only a specialist could fully appreciate. Maybe you need unique furniture appraisal or wish to document the actual value of grandma’s dinnerware or grandpa’s 1960’s TV shows lunchbox collection.

Art appraisal can be an especially sticky wicket. The dollar worth of a specific sketch, photograph, or sculpture can seem so elusive, and rapidly evolve based not only on what the piece is, but who created it, and during what “period” they were in. What had they done just before this sculpture? What have they painted since this sketch? How am I supposed to value my things when they are, like art, subjective by nature? Even the most straightforward painting value partly depends on things you’d rarely consider with other items. Who else has owned this? Where’s it been? Does anyone famous want it at the moment? What are the chances someone powerful will want it ten years from now?

Let’s assume you’re not torn between a family outing to the Bahamas or purchasing that Monet you’ve had your eye on once you have a solid painting value estimate from the art appraisal store down the street (next to the Clock’n’Hock). Chances are neither you nor I will be making worldwide news when you make that purchase or when I appraise my stuff. But an accurate art appraisal may still be essential to making wise choices about updating my property insurance. A certified painting value can make the difference between being approved for that personal loan on terms I can live with or telling my son he’ll have to elope and my daughter she’ll have to do without that master’s degree.

I don’t need to compete with the Buffets and Gates of the world to complete my Jackson Pollack collection or fill in the last slot on my Rothko wall. I just need a reliable online art appraisal from creditable sources for the weird Nathan James-inspired collection my brother-in-law left us so I can use it to guarantee that debt consolidation loan. They can keep the weird cheese and frou-frou wine; I’m trying to value my things accurately so I can decide whether to hold on to these photos of fast food signs as “revolutionary visual commentary on quotidian Americana” or sell them to that annoying collector for enough to pay off my credit card debt entirely – hopefully before he figures out that as near as I can tell, these are just overpriced snapshots of Braum’s and Taco Bell.

Wouldn’t it be nice if you didn’t have to slog through the politics and pretense of an entirely different world to make a few good decisions about your personal finances? Wouldn’t it be convenient to take a few snapshots and enter some basic information as easily as you text your partner about dinner plans and receive an online art appraisal within days? Wouldn’t it be amazing to casually draw on experts across the nation and easily peruse amalgamated data from thousands of similar transactions as recently as yesterday?

We didn’t design accūRATE so you could “beat the system”; we created accūRATE so you could take more effective control of your own financial decisions and better respond to decisions others might make which impact you and those you love. We didn’t innovate the EquityMizer so that we’d have a cooler gimmick than the next guy (it’s so much more than that); we re-imagined the possibilities because we believe in the power of information made useful and accessible.

Imagine applying that same innovation to appraisals and insights for almost anything of value you might possess. For almost anything you’re considering buying, selling, insuring, storing, or offering as collateral for that personal loan that might mean so much. For taking more effective control of your personal and small business finances. Imagine yet another game-changing leap forward in terms of your personal access to knowledge and expertise. Imagine the confidence that comes from understanding the value of almost anything.

It may be that the only real value of those wonderful things you’ve been sitting on for years is emotional. That’s OK – you probably didn’t really want to get rid of them anyway. On the other hand, what if those Gunsmoke lunchboxes are THE lunchboxes mentioned in that article you found online? How can you tell? It seems unlikely that the guys down at Clock’n’Hock are going to know the difference – even if they keep pretending they do.

Imagine being able to walk into your local bank or credit union or attach to your online loan application a certified value assessment for almost any item. Imagine taking a few pics and entering a little basic information as easily as you’d check your balance or complain about local politicians on social media. Imagine that within 48 hours or less, you could have input and appraisals from actual experts in almost any field. Imagine if today’s technology allowed you to move beyond the bondage of your ZIP code and allowed you to virtually travel the globe seeking options and input without buying a single airline ticket or booking a single hotel room?

We’re big fans of supporting local business. By all means, see what they have to say. Keep in mind, though, that my ability to value my things in the confines of my ZIP code, my city, or even my region, is not the same as the ability to value my things as part of the interconnected 21st century. Any antiques or collectibles dealer will tell you that while they’ll do the local shows and set up their booths and bring their monogrammed tablecloths, that’s largely to build name recognition and dump overstock or unload last year’s poor decisions. The real money in rare books, collectible vinyl, or unique furniture is online. It’s the larger market. Any meaningful non-traditional property valuation has to come from the larger market as well.

Check out the rest of Accury and the wider Goalry family. But while you do, keep your eyes on this page. And imagine what’s coming next.