Maximize Equity

Equity is the percentage of your home’s value which belongs to you as opposed to the amount still owed to the original lender or other creditors along the way. The most basic way to estimate house equity is to subtract the amount you currently owe from current home value.

Equity is a financial concept used to make decisions about loans and terms and other financial things. In practical terms, as long as you’re making your payments on time each month, the property is entirely yours. Your local bank manager isn’t likely to show up in your tub one morning eating your cereal because she still “owns” 35% of the property’s value.

Estimating home equity isn’t a complex process. You only need to know two things – the balance you still owe on the home, and your approximate house property value. It’s not difficult to determined precisely how much you still owe on your mortgage. (If you don’t know, ask the lender.) It can be slightly more challenging to accurately check property value. Your most recent property tax evaluation might be a good place to start, or you could hire a professional appraiser to walk through and do a full appraisal.

The more accurately you can assess house market value for the property in question, the closer your estimate of home equity.

The equity you have in your home can be used to secure home improvement loans, pay for college or other post-secondary education, pay down debt, or whatever else you decide is an appropriate use of your own money. Because you’re able to put up a percentage of your home as collateral (that’s the “equity” you have in the home), you’re far more likely to be offered favorable terms and decent interest rates. A better debt-to-equity ratio makes you a better credit risk and can help improve your credit score, which in turn influences all sorts of things.

Plus, it feels good to get closer and closer to owning your home and knowing that home has true, intrinsic value, not only as a place to live and enjoy but as the single largest investment most of us will ever make. So, if equity is home resale value minus balance owed, then there are two basic approaches you can take to maximize equity: increase the value of the property or lower what you owe on the principal.

The usefulness of complete and accurate information doesn’t stop with buying and selling. When you’re considering adding on to your home, or making major repairs or renovations, you need to know precisely how much equity this investment will add in order to make the best decision about how much you’re willing to spend and which changes make the most sense. Imagine accessing the EquityMizer as easily as you pull up funny Tik Tok videos or respond to that text from your mom about why you never call.

Should you remodel that kitchen? Imagine asking the EquityMizer how much value it would add? Will it get my house price up enough to justify the cost? Not in theory, not maybe in other homes somewhat like yours. Imagine describing THIS kitchen in THIS home on THIS street if the home were put on the market THIS year and finding out almost instantly that it while it would raise the value of your home, it wouldn’t be quite as much as the cost of doing the remodel.

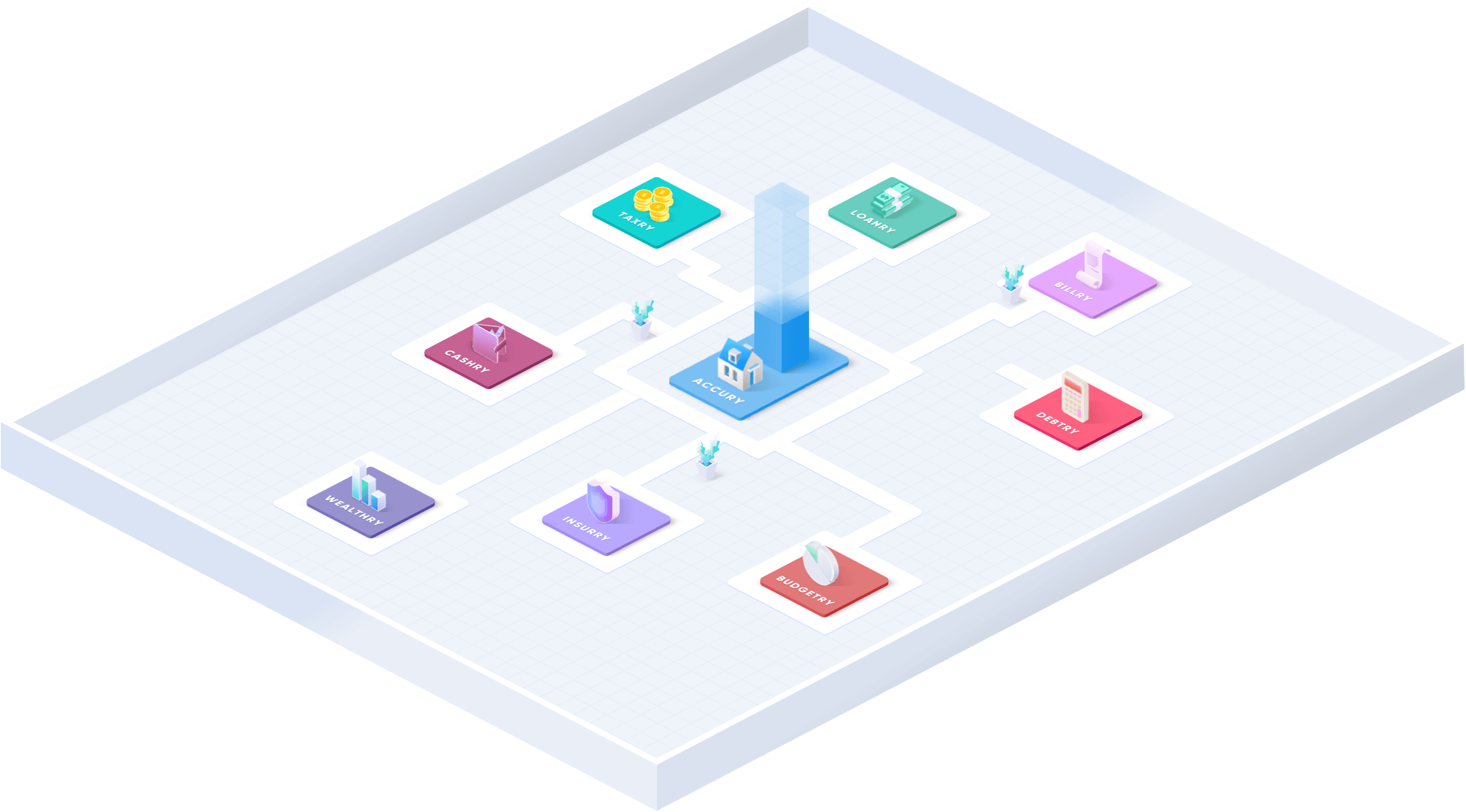

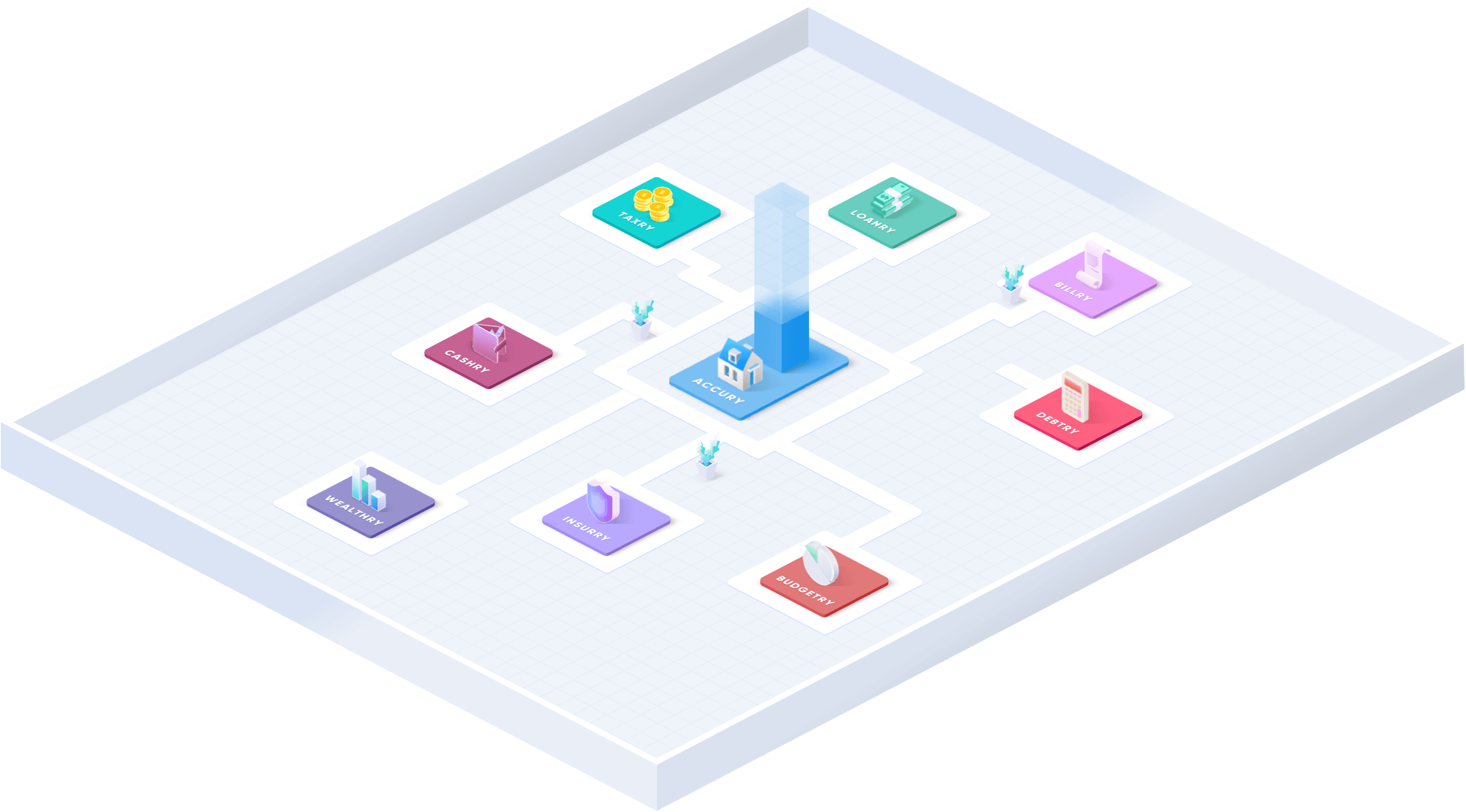

That’s one of the guiding philosophies which led to Accury and the larger Goalry family of unified finance. We believe most people can take far more effective control of their personal and small business finances if they simply have access to the right information, tools, connections, and opportunities. When it’s time to check property value or evaluate home equity, you need something better than estimates. Other sites attempting to guess the actual market potential of your home value real estate based on algorithms and “comparables” available from commercial realtors. At Accury, we prefer to not to settle for estimates. We’d rather be accūRATE.

The decision is still yours, but without so much guesswork. Should you update that bathroom? Imagine feeding the details to EquityMizer and discovering that doing so could improve your equity and raise the potential sale price of your home by the cost of the work plus another 40% or 50%! All with a few swipes or clicks from any connected device, from wherever you happen to be, and when you actually need the information.

Technology in the modern era still isn’t very good at making major decisions about our health, finances, relationships, or overall happiness. What it is good at is taking huge amounts of complex information and making it available in almost any form according to any specifications requested. Certified appraisers are walking the property and filing the detailed reports anyway. Wouldn’t it be nice to get a peak at just the parts you need whenever you need them? The real question isn’t whether or not accūRATE and the EquityMizer are game-changers. The real question is why no one else has managed to design the tools to allow you and I to access this information in this way ever before.

It’s not always even a choice between remodeling or adding on for ourselves and our families OR making changes in order to maximize equity. Sometimes we make major improvements to our home because we want to benefit from them while we live there, but at the same time we want to factor in how much we’re likely to gain in equity or potential selling price as we decide exactly how far to go and how much to spend. Whether we’re looking to put money into our homes primarily for personal enjoyment or simply in order to maximize equity, the more accurate information we have, the better decisions we can make.

Imagine detailed, certified appraisals for any property you’re considering buying or selling, at your fingertips whenever you need them and wherever you are. Imagine being able to determine precisely how much that breakfast nook adds to the certified value of a home or how much the mortgage company will deduct based on the wear and tear in that master bath. Knowledge is power, and accūRATE makes that knowledge as easy to access as last night’s sports scores or those cute pictures of your dog.

Transparent pricing has revolutionized the auto industry and the sales of almost every other big ticket item. Why should it be difficult to find out property values so that you can make better decisions? There’s a reason more and more people are calling Accury the most accurate home value site on the web. Why estimate when you can accūRATE?

Whether you’re primarily concerned with the potential equity increase or simply wish to get out of debt more quickly, there are several simple things you can do to more quickly reduce what you owe on your home.

Most mortgages are set up to be paid monthly, while many of us get paid at our jobs every two weeks. If you pay half your monthly mortgage every two weeks, you end up paying 26 half-payments per year instead of 24 – in essence, you pay an extra month’s mortgage every twelve months. On a typical thirty-year mortgage, this can mean paying tens of thousands of dollars less over the life of the loan. It can also shave five years or more off the length of the loan, making the home fully yours much sooner than it would otherwise be.

Regular payments are split between principal and interest. For the first decade or so of your mortgage, most of each payment goes towards interest. Paying even slightly ahead of what’s required means the extra money goes to the principal of your loan, giving those extra payments far more impact than might first be obvious.

It’s important to check with your lender and verify that this is how they’ll treat early or extra payments. Some lenders have begun attempting to take advantage of the growing popularity of this or similar methods by weaving language into the small print which offsets the value of early or extra payments. And there’s absolutely no reason to rely on a third party to make this happen. There’s nothing an outside service can do to help you maximize equity through paying down principal that you can’t do yourself with very little extra time and effort.

If you receive a larger-than-expected tax refund, or stimulus money, or inherit a modest sum from dearly departed Aunt Beulah, consider applying it towards the principal of your home loan. Just like in the case of bi-weekly or extra payments, verify with the lender how this money will be applied first.

In the typical mortgage, any extra payments go straight towards the principal. On a standard thirty-year home mortgage, even one with a fairly low interest rate, even a few thousand dollars in the first few years can mean exponential savings over the life of the loan. Plus, that unexpected money you apply towards the balance of your loan becomes immediate equity for down the road.

If you can’t pay bi-weekly and don’t expect to come into many lump sum windfalls anytime soon, consider something as basic as paying an extra $50 or $100 each month along with your required mortgage payment. There are numerous online mortgage calculators which will let you play with the numbers to see what this will do for you over time in terms of building owner's equity and reducing total interest paid and such.

The point is that you have options. Every little bit helps. And in the case of a home mortgage, every little bit extra helps far more than you’d think.

There are several ways to do this. Most involve increasing home resale value by making improvements to the property itself. These can be substantive or primarily aesthetic. The average home price in any neighborhood is also a product of the neighborhood itself, as well as nearby amenities. In other words, by improving your community, you’re also increasing your own home equity along with that of many others in the area.

The most obvious way to get home value up is to do repairs, renovations, or additions. Even relatively inexpensive endeavors like a good pressure washing or fresh paint can raise house property value instantly. Home improvements you do yourself are sometimes referred to as “sweat equity.” You’re primarily investing your own time and energy into things that increase your current home value. Even if you’re not particularly handy with advanced tools or major renovations, you can probably replace loose, rusty nails with newer. You can watch some YouTube videos for tips on refinishing that cracked, nasty bathtub or replacing that obsolete toilet.

You don’t even have to have an impressive toolbox to make sure your yard is mowed and your bushes trimmed. Figure out who you can call to haul off that rusty old swing set and either fix that old car out back or sell it for scrap metal. You may think that if you wanted to sell the home to someone as a “fixer-upper,” they’d be happy to do those things in exchange for a reduced price. That overlooks two important issues. First, we’re focused here on how to maximize equity – to improve house worth as financial leverage or security. That means now. Second, you’re cutting your potential buyer pool by more than half leaving work undone. The typical 21st century buyer doesn’t want to begin their life in their new home by fixing up your leftover damage.

These are the things we all suspect we should be doing anyway. Go to those homeowners’ association meetings, or start them if they’re not already a thing. Look for practical, non-confrontational ways to improve the safety and aesthetics of your neighborhood. Sometimes just getting volunteers to mow public areas or pick up trash along the main roads once a month can make a huge difference in both average house market value and quality of life for you and your families. Communicate with local officials to make sure basic needs are taken care of – potholes, speed limit signs or speed bumps, maintenance of public areas, the right sort of attention from police and fire departments.

Get involved in your local public schools. Assist with tutoring, go to football games, or provide items for the drama club’s bake sale. Support local educators and your local libraries – even if your initial goal is to see that equity increase, chances are you’ll find it personally gratifying as well. Talk to other homeowners about putting together a crew to help elderly neighbors or anyone else not able to keep up their property as well as they’d like. Mow some lawns, do some basic maintenance, and share a group meal or two. There may even be a local church or other community organization willing to assist with the logistics.

One of the most overlooked ways to maximize equity is to make the area around the home a better place to live. It just so happens that getting involved in this way is good for you, your family, and your neighbors in many other ways as well.

If your primary purpose for repair or renovation is to maximize equity, it matters how much those improvements are going to cost you when compared to how much they’ll increase home resale value. If this is your central consideration, you really only need two pieces of information to make your decision. The first is an accurate idea of how much the repair or renovation will cost. (That’s between you and whatever local talent is available and willing.) The second is an accurate idea of what the work will do to maximize equity or improve home resale value.

As you probably know even the more accurate home value websites are really just running algorithms and doing fancy guesswork based on things like square footage, the age of the home, and the sales of “comparables” in the area – homes of similar size, age, and features which have sold in your neighborhood or similar neighborhoods in the previous year.

There’s nothing wrong with using these as starting points when you’re first considering buying, selling, or making changes to maximize equity. It’s quite a wonderful reality of the 21st century that you can pull up pretty much any property online to check house value estimations and get all sorts of other information about your friends, neighbors, or anyone else anonymously, and with just a few clicks. Some will even let you virtually “tour” the property inside!

But when you’re talking about the market value of home improvements or the most cost-effective ways to increase an owner's equity, you need more accurate home values than even the most adorable home value search sites can offer you. Even in the 21st century, obtaining the most accurate home value requires a certified appraiser touring the property – in person – and submitting a detailed report on every significant feature or issue.

We know that the money you invest in your home is a big deal. It may not always be easy to determine the best course or whether or not to make this offer or approve that renovation. That doesn’t mean, however, that it has to remain as difficult as it has been in the past. And it doesn’t mean you have to figure it all out alone.